QuickTips RSS

QuickBooks Desktop Will No Longer Be Sold to New Customers

Big Changes are Coming for QuickBooks Pro, Premier, and Nonprofit Desktop Versions.

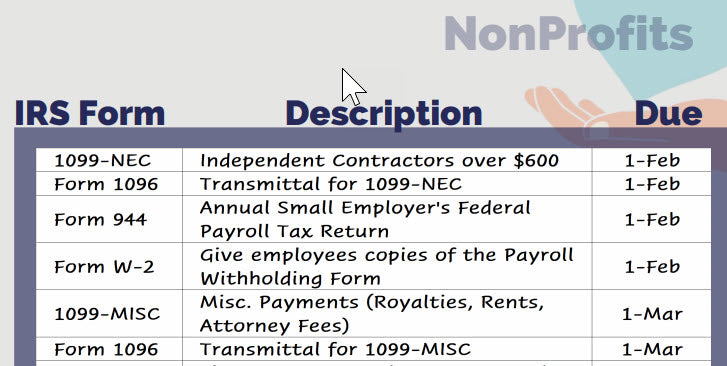

2021 IRS Deadlines for Nonprofits

New IRS Rules for 1099 Independent Contractors

Along with all the other changes we have dealt with in 2020, the IRS has also changed how organizations report the money paid to independent contractors, or as they prefer to label it, Non-employee Compensation.

In past years, if your organization paid a person for services who was NOT an employee, you may have needed to file a 1099-Misc for the total amount given over the year. The 1099-Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors.

Starting in 2020, the IRS now requires payments to independent contractors are shown on a new form 1099-NEC (non-employee compensation) instead of the 1099-MISC (miscellaneous).

Table of Contents

What is Non-employee Compensation?

How do I determine who are Independent Contractors?

How do I know which contractors need to receive Form 1099 this year?

How do I fill out Form 1099-NEC?

What do I do to my chart of accounts for the 1099 changes?

How to Record Opportunity Scholarships in Your School

It is time to go back to school (hopefully!). If your school receives scholarships from a governmental unit for specific children, you can track these in QuickBooks. The examples I’ll be showing are using the Premier version, but the same concepts work for QuickBooks Online. Assumptions: Let’s start by reviewing the assumptions. For this example, I assume: the parents apply directly to the government or grantor for the scholarship money is paid directly to the school payments are received by semester from the grantor if a student drops out, the scholarship money is prorated and given back to the grantor...