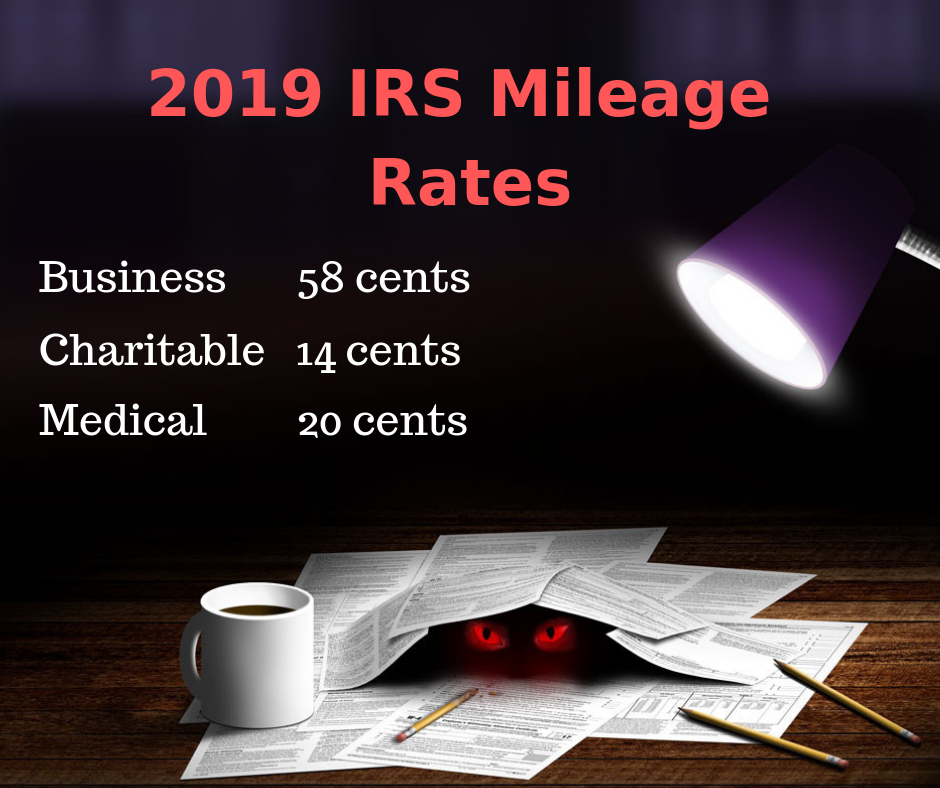

2019 Mileage Rates for Business and Nonprofit Work

The IRS has issued the 2019 mileage rates.

The business mileage rate has increased to 58 cents per mile (up 3.5 cents from 2018). You may need to adjust your budgets and planning accordingly.

For miles driven while helping a charity, you may use 14 cents per mile.

If you need to drive for medical reasons, you can use 20 cents per mile (a 2 cent increase).

I'd also like to offer a heads up- since the Tax Cuts and Jobs Act, you can no longer deduct unreimbursed employee travel expenses.

Check out BANISH Your Bookkeeping Nightmares for more information on what is and isn't deductible, how to fill out those IRS self employment tax forms, the Schedule C-Business income form and so much more.