The best approach to bookkeeping for budding entrepreneurs is here!

If you’re one of the thousands of self-employed people out there, you understand the difficulty of juggling the needs of your small business. Let this guide ease your financial woes so that you can focus on your thriving business.

No prior accounting knowledge? No problem! Lisa London’s step-by-step instructions and generous illustrations take the fear and frustration out of accounting for the self-employed. This book will walk you through up setting up an accounting system, how to file quarterly employment taxes, and shows the detail behind deductions on Schedule C, and more!

Using the BANISH system, this book will teach you how to:

- Analyze financial data required for small business accounting

- Maximize physical and virtual office space

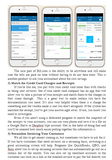

- Use your mobile phone to make taxes and accounting easier

- Manage payroll, bills, and other outgoing cashflows

- Calculate deductible expenses (e.g., home office deduction) using one simple rule

- Tackle self-employment taxes and give the IRS what information they need

- Fill out necessary IRS federal forms, line by line

- Budget for your business with your goals in mind

Lisa London is a CPA and top-selling author with decades of experience who has helped organizations reduce their accounting time dramatically. Her series The Accountant Beside You is written for non-accountants to understand the basics of accounting with concise instructions, loads of illustrations, and no confusing jargon.

Whether you are an AirBnB host, an Uber driver, or any other type of solo entrepreneur, let The Accountant Beside You BANISH your bookkeeping nightmares for good!

Contents

The BANISH System

BANISH Step 1—Brief Yourself

A. How Do You Know What You Need?

B. State Required Forms

C. Bank or Other Lender Requirements

D. What do YOU Need to Run Your Business?

E. A Quick Accounting Lesson (I promise it won’t be painful.)

F. Cash vs Accrual Methods of Recording Income and Expenses

G. Financial Reports

BANISH Step 2—Arrange Your Environment

A. Computer Organization

B. Office Organization

C. Car/Mobile Organization

D. Record Retention Guidelines

E. Email and Other Electronic Information

BANISH Step 3–Network Your Data

A. Desktop or Online?

B. Lower Cost, but Takes More Time Options

C. Saves Time, But Costs a Bit More

D. Automate Where Possible

BANISH Step 4—Import Your Transactions

A. Design a Chart of Accounts for Your Business

B. Record Transactions—The Basics

C. What is Deductible?

D. Paying the Bills

E. Recording Your Income

F. Paying Yourself

BANISH Step 5—Summarize Your Information

A. The End of each Month

B. The End of the Quarter

C. It’s Year End. What Now?

BANISH Step 6—Head Into Next Year

A. Budgeting—An Annual Approach that is Your Secret Weapon

B. Forecasting—Evaluating as The Environment Changes

Appendix

A. Deductible Expenses from Schedule C

B. Home Office Deductions

Book Information

BANISH Your Bookkeeping Nightmares--The Go-To Guide for the Self-Employed to Save Money, Reduce Frustration, and Satisfy the IRS

Author Lisa London, CPA

ISNI 0000 0004 5059 7909

ISBN 978-1-945561-07-8

Library of Congress Number 2017935070

Published November 2017 by Deep River Press, Inc.

Copyright 2017 Deep River Press, Inc.

118 Pages

Order Information

Setting up an account is not required but recommended to make it easier to track your shipments and download any digital files.

E-Books and any digital files are available immediately. You will be taken to a link to download the Kindle or PDF version directly to your computer.

Paperbacks are usually shipped within a day via USPS. There is a flat rate of $4.95 for books sent in the continental US via media mail. Priority mail 2-3 day service is usually available for $8.95. For shipping costs outside the continental US, go through the checkout process, and the fees will be calculated for you.