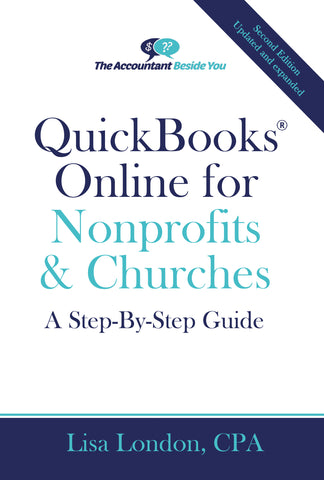

Updated and Expanded for 2024! Optimize Quickbooks Online For Your Nonprofit!

Church and nonprofit accounting pose their unique challenges, but QuickBooks Online for Nonprofits & Churches will guide you through the intricacies of QuickBooks Online for your church accounting or nonprofit accounting. No accounting experience? No problem! Alleviate frustration and speed up your bookkeeping with this easy-to-read manual for QuickBooks online.

Learn the steps needed to set up your nonprofit accounting system with these features:

- Master QuickBooks online basics specifically for your nonprofit

- Design an online nonprofit chart of accounts that will yield the reports you need,

- Track the progress of your nonprofit's grants and programs online

- Import information for customers, donors, and vendors to QuickBooks online

- Receive and record donations, pledges, dues, and other incoming cashflows

- Manage expenses and payroll efficiently

- Reconcile bank and credit card feeds to save time

- Configure budgets that meet your organization’s targets

- Design and run month-end and year-end reports

- Conduct fund accounting

- Handle fundraisers, mortgages, and reserve accounts

- Handle your finances conveniently from quickbooks online mobile app.

These books are written for non-accountants to understand the basics of nonprofit accounting with step-by-step instructions, loads of illustrations, and no confusing jargon. This isn’t just quickbooks for dummies—this easy-to-read, detailed guide will teach you how to look after the whole financial well-being of your church or nonprofit. Think of the book as a support manual to be referred to anytime you need help.

If you are looking for help with QuickBooks Pro, Premier, or Non-profit versions, click here to see QuickBooks for Nonprofits & Churches A Step-By-Step Guide to the Pro, Premier, and Nonprofit Versions.

QuickBooks Online for Nonprofits & Churches explains the ins and outs of QuickBooks Online. If you are using QuickBooks Pro, Premier, or Nonprofit version, check out QuickBooks for Nonprofits and Churches-A Step-By-Step Guide to the Pro, Premier, & Nonprofit Versions.

Lisa London, CPA, understands that not everyone thinks like an accountant. That’s why she started The Accountant Beside You series to assist non-accountants in untangling the financial knots that come with running a small business, church, or nonprofit organization. She walks readers through the process of setting up QuickBooks from a chart of accounts custom-designed for churches, to running the reports for the year-end and preparing for an audit. Take control of your organization’s finances with The Accountant Beside You!

Contents

1. QuickBooks Online & Nonprofits

A. Will QuickBooks Online Work for My Organization?

B. Advantages of QBO

C. Fund Accounting

D. Reporting and Terminology Differences

E. The Case for Internal Accounting Controls

F. Advice for the Governing Body of the Organization

G. Tips, Hints, and When to Let Someone Else Do It

2. Acquainting Yourself with QBO

A. Layout of the Program

B. The Basics

C. Find and Correct Posted Transactions

D. Using QBO Help

E. Lists and Transaction Entry Screens

3. Setting up Your Organization File

A. Required Information

B. Creating a QBO Account

C. Exporting Existing QuickBooks Desktop Data to QBO

D. Account and Settings

1. Company Settings

2. Usage

3. Sales Settings

4. Expenses/Expenditures Settings

5. Payment Settings

6. Advanced Settings

7. Other Options under YOUR COMPANY

E. Lists

F. Tools

G. Profile

4. What is the Chart of Accounts?

A. Designing the Chart of Accounts

B. Numbering Structure

C. Naming the Accounts

D. Building the Chart of Accounts

E. System Generated Accounts

F. Adding New Accounts

G. Tracking Restricted Cash

H. Upload a Chart of Accounts

I. Enter Chart of Accounts (COA)

J. Editing, Deleting (Deactivating), and Merging Accounts

K. Beginning Balances

5. How do I Track My Programs & Funds?

A. Using Classes

B. Naming of Classes

C. Entering Class Lists

D. Editing or Deleting Classes

E. Locations

F. Tags

G. Recording the Beginning Balance Entry

6. Donors, Grants, & People I Owe Money To

A. Setting up Members and Other Donors

B. Setting Up Vendors (The People You Pay)

C. Importing Donor and Vendor List from a Spreadsheet

D. Projects

7. Products & Services—Tracking the Transactions

A. Product and service types

B. Setting Up New Products and Services

8. Money In—Recording Donations & Revenues

A. Accounting Controls for Receipts

B. Money Received During Meetings or Fundraisers

C. Money Received During Religious Services

D. Money Received Through the Mail

E. Payments Received Through the Website or Mobile Sites

F. Entering Donations

G. Acknowledging the Donation

H. Entering Cash Receipts

I. Entering Donations from a Separate Donor Base

J. Dues & Pledges—Billing and Payment

K. Entering Beginning Receivable Balances

L. Receiving Payments on Dues or Pledges

M. Invoicing and Receipt of Restricted Funds and Grants

N. Miscellaneous Receipts

O. Pass-Through Collections

P. Undeposited Funds

Q. Printing a deposit slip

R. Recurring Donations from Credit Cards

9. Money Out—How Do I Pay the Bills?

A. Cash vs. Accrual Methods

B. Internal Accounting Controls for Paying Bills

C. Controls for Electronic Payments

D. Entering Bills

E. Beginning Accounts Payable Balance

F. Uploading Bills

G. Editing and Deleting Bills

H. Recurring Bills

I. Enter Credit Card Charges

J. Paying Bills

K. Write Checks

L. Handwritten Checks

M. Paying the Credit Card Bill

N. Credits Received from Vendors or on Credit Card

10. Payroll

A. Entering Employees and Contractors

B. Using Journal Entries to Record Payroll

C. Entering Payroll through the Check Entry Screen

D. Paying the Benefit Contribution

E. Tracking Time for Projects

11. Bank Transactions & Reconciliations

A. Banking

B. Connecting Your Accounts

1. Understanding Bank transactions

2. Understanding Rules

C. The Receipts Tab

D. Preparing for the Bank Reconciliation

1. Internal Controls and Bank Reconciliations

2. Cash Transfers

3. Transfers without Writing a Check

4. Transfer Cash via Check

5. Returned Checks

6. Voiding a Check

E. Reconciling the Bank Account

F. Credit Card Reconciliation

G. Reconciling Petty Cash

12. Where Do We Stand? —Designing & Running Reports

A. Types of Reports

B. Defining the Parameters and Saving Customizations

C. Most Useful Reports

D. Exporting Reports to a Spreadsheet

E. Other Miscellaneous Reports

F. Dues Receivable, & Donor Information

G. Accounts Payable & Vendor Information

H. Deposit Detail

13. Am I Meeting My Targets? Budgeting

A. The Budget Process

B. Entering Your Budget

C. Importing Budgets

D. Budget Reports

14. It’s Month End &/or Year End—What Now?

A. Month and Year-End Checklist

B. Reviewing Your Transactions

C. Allocate Fund Balances

D. Restricted versus Unrestricted Cash

E. Year-End Adjusting Entries

F. Board Reports

G. Year-End Closing

H. Year-End Donor Acknowledgments

I. Other Year-End Requirements

1. 1099 Filings

2. File W-2s for Employees

15. Special Topics

A. How Do I Account For …???

1. Fundraisers

2. Record the Sale of Merchandise

3. In-Kind Donations

4. A Reserve Account on the Income Statement

5. Interfund transfers

6. Stock Donations

7. Investment Gains and Losses

8. Mission Trips or Member-Specific Accounts

9. Opportunity Scholarships

B. How Do I???

1. Invite and Manage Multiple Users

2. Send a Thank You from the Receipts Screen

3. Customize Forms

4. Using the purchase order option on grants

5. Merge duplicated donor or vendor accounts

6. Give Feedback to QBO

C. What About …???

1. Reports I Need for an Audit

2. Tax Stuff

16. QBO Apps

A. QBO from your Mobile Device

B. 3rd Party Developer Apps

Save time and money by bundling with other resources to run your nonprofit or religious organization. Click here for the Nonprofit version and here for the Church version.

QuickBooks Online for Nonprofits & Churches-A Step-by-Step Guide

E-Books and any digital files are available immediately. You will be taken to a link to download the Kindle or PDF version directly to your computer.

Shipping: Paperbacks are usually shipped within a day via USPS. There is a flat rate of $3.95 for books sent in the continental US via media mail. Priority mail 2-3 day service is usually available for $8.95. For shipping costs outside the continental US, go through the checkout process and the fees will be calculated for you.