Accounting for Gift Card Fundraisers

Many grocery stores and other businesses offer gift cards to nonprofit organizations at a discounted rate to use as a fundraiser. This allows the nonprofit to buy the gift cards at a discounted value, sell them at face value, and keep the difference. If your organization participates in this type of fundraiser, you will need policies and procedures to safeguard the cards and account for the transaction properly.

Store cards are like cash and controls should be in place to protect them. Keep the cards in a secure location. Designate one person (without access to the accounting records) to be responsible for handling the cards. When you purchase the cards, set up a log like you would for a petty cash fund. On the log, record the total number of cards and their values. As the cards are sold, note who bought them, the number of cards sold and the dollars received. If they were used for internal purposes, i.e. to purchase food for the Youth Group or to give as a thank you to volunteers, record the number of cards used and the program to charge them to. At the end of each month, a separate person should count the cards and reconcile them to the log.

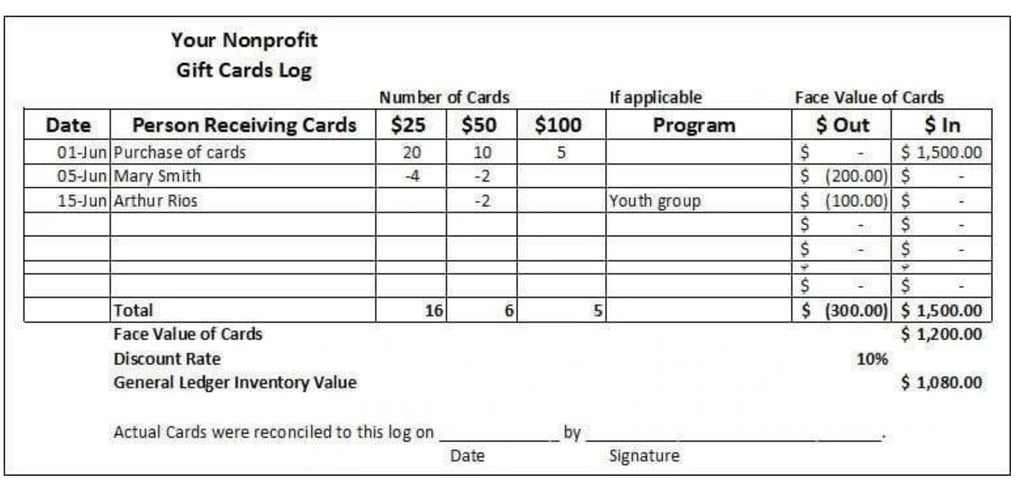

Here is an example of a Gift Card Log.

To save time, I've added this file to the Freebies tab under Nonprofits. You can download the Excel spreadsheet template to use for your organization.

Recording the transactions

You will need to first set up an inventory account on the balance sheet. Then record the purchase, sales and use of the cards as follows.

Purchase:

Debit Inventory (Asset) xxx

Credit Checking/Cash xxx

Sale as a Fundraiser:

Debit Cash xxx

Credit Inventory (at cost of the card) xxx

Credit Fundraising Income* xxx

* Income is the difference between the cost of the card and the amount received for it.

If you are using QuickBooks, you can set up an item to automatically reduce the inventory and record the income when you sell the item. First, make sure the Inventory Preference is active. Go to Edit, Preferences, Items & Inventory, Company Preferences, Inventory and purchase orders are active.

Next, go to Lists, Item, New and select Inventory Part.

After you give it a name, input the cost of the card. Then the system will ask for a Cost of Goods Sold account. I prefer to put it to the Fundraiser Expense account as discussed in QuickBooks for Churches and Using QuickBooks for Nonprofit Organizations. The face value of the card is input in the Sales Price box and the Fundraiser Income account is selected. Don't forget to designate the Inventory account you recorded the original purchase to.

Set up a new item for each different type of card (i.e., $25, $50, etc.). Once the items are set up, you can record the sale of a gift card through the Sales Receipt screen or the Invoice screen. The system will automatically reduce inventory and record the sale with the related cost.

After the entries are made, the ending balance on the card log should equal the inventory balance on the balance sheet. If it does not, investigate to see if cards are missing or if a miscalculation has been made.

If the cards are given to volunteers to sell, you can keep track of the value of cards outstanding, by using the Accounts Receivable option. Set up a new customer account for each volunteer that will be taking the cards. If they are also a donor, set up a separate Customer account for them as these transactions should not be reflected on their year-end donor acknowledgments.

When issuing the cards, set up a Customer Invoice for the number and amounts of cards received by the volunteer. If you have set up the Item as explained above, the system will automatically reduce inventory and record the sale. The accounts receivable is increased for the face value of the cards. Once the cash is given to the organization from the volunteers, it is treated as a payment of that volunteer's invoice.

You can use these same concepts for other things your organization may sell like tee shirts or books.