Do I Need to File a Form 990EZ? When Do I File a 990 N or 990 EZ?

Form 990 Annual Filing for Exempt Organizations Deadline Change

The IRS form 990 is ordinarily due by the 15th day of the 5th month after the end of the charity’s tax year. But 2020 has been anything but ordinary.

Organizations with calendar year-ends who need to file a Form 990, 990EZ, 990N, or 990T, the deadline was moved from May 15th to July 15th. It was nice to have a breather, but July 15th is going to be here before we know what hits us.

If your year-end is the end of February or later, you will still use the same 15th day of the 5th-month deadline.

Do I Need to File a Form 990?

Here are the basic rules:

- Churches and other religious organizations are NOT required to file a report annually unless they have a designation letter from the IRS and want to have information on public record for potential donors.

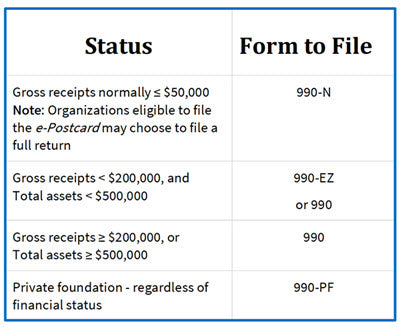

- All 501(c)3 organizations are required to file one of the three types of 990s, depending on donation and asset size.

- For organizations with gross receipts normally less than or equal to $50,000, the 990-N (otherwise known as the e-Postcard) is required.

- If the organization has been in existence for less than a year and received cash or pledges of $75,000 or less, or

- Has been in existence between one and three years with an average of $60,000 or less of gross receipts, or

- Is at least three years old and average $50,000 or less in gross receipts for the past three years; they can still file the 990 N.

- Any organization required to file the 990-N can choose to file Form 990EZ or the full 990 if they want that data on the public record.

- If your organization has gross receipt less than $200,000 and total assets (buildings, pledges receivables, cash and investments) less than $500,000, you may file the 990-EZ (or complete the full Form 990).

- If the gross receipts are greater than or equal to $200,000 and total assets are greater than or equal to $500,000, the full Form 990 is required.

Form 990 EZ has several required schedules, including Schedule A (Public Charity Status and Public Support), which is designed to show the IRS that you are NOT a private foundation, but receive a substantial amount of your support from the general public. This is called the 33 1/3% test. The schedule requires you to document where your money is coming from over several years.

Schedule B (Schedule of Contributors) is required if you had donors who gave over $5000. It is a four-page form that asks for the type of organization and whether you are covered under the general rules or special rules which are listed. It also asks for the names and addresses of the significant contributors.

The 990 EZ can be a bit confusing to fill out. In my book, Nonprofit Accounting for Volunteers, Treasurers, and Bookkeepers, I take you through the 990 N, 990 EZ, and Schedules A & B on a line-by-line basis to help you each step of the way. If you need to fill out the complete Form 990, I highly recommend using a local CPA with nonprofit experience.

Does a Nonprofit Have to Pay Taxes?

Maybe. If your nonprofit brings money in from a source unrelated to its exempt mission, it may be Unrelated Business Income and may be taxable. I have a blog on UBIT (Unrelated Business Income Tax) I highly recommend you reading.

If you think you may owe taxes, you will need to complete IRS Form 990-T (Exempt Organization Business Income Tax Return). It is due on the same date as the Form 990, 990ez, and 990n. If you would like help on how to fill out the 990-t, check out Nonprofit Accounting for Volunteers, Treasurers, and Bookkeepers. I go through detailed examples of unrelated business income and take you line by line through the 990t.