MileIQ App is offering The Accountant Beside You readers a 20% Discount

In Banish Your Bookkeeping Nightmares-The Go-To Guide for the Self Employed to Save Money, Reduce Frustration, and Satisfy the IRS, I explain the need for the self-employed to track their vehicle mileage in order to take advantage of the tax deduction for business travel (53.3 cents per mile in 2017). If you aren't self-employed, but drive for your volunteer work, you can also take a deduction for the miles (14 cents per mile in 2017).

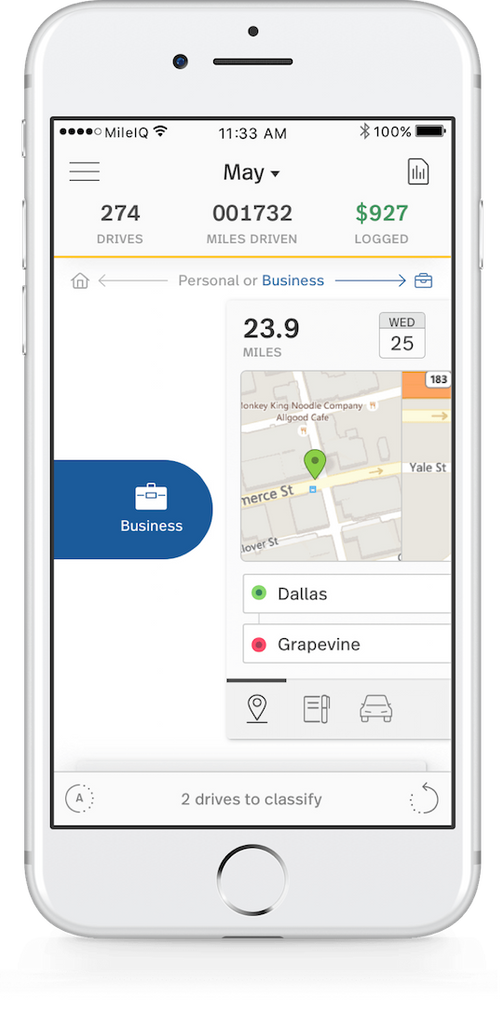

To track your mileage, you have to keep a travel log in your car and write down the miles as you go, or you can download an app to your phone that will automatically log your trips. One of these apps is MileIQ. You swipe each drive to classify it as business or personal, and MileIQ calculates the value of your deductible mileage. You can add details like parking, tolls, purpose and vehicle and have a complete, accurate mileage log practically effortlessly.

Your log gets synced to the cloud, so you can get to it any time, even years down the road, without having to worry about losing that paper log. MileIQ is offering my clients a 20% discount on annual unlimited-drive plans. Subscriptions are regularly priced at $5.99/mo. or $59.99/yr.

You can try MileIQ by downloading the free app for iOS or Android. To get an annual unlimited-drive plan at a 20% discount, sign in to your MileIQ web dashboard, click "Get Unlimited Drives" and use promo code LLON471A at checkout. (Note: you'll need to log in to the dashboard-the discount is not valid for in-app upgrades or monthly plans.)

By the way, I am not associated with MileIQ and receive no benefit-I just like to offer my readers discounts whenever I can.

Want more information? Take a look at this flyer and use promo code LLON471A. Remember, the subscription is usually deductible and at 53.5 cents for every business mile, it'll pay for itself in just a few drives!