Who Are Independent Contractors and How Can I Get 1099s for Free?

I hate to disrupt your activities during this ridiculously busy time of the year, but if you would like to receive FREE IRS Form 1099-MISC, you will need to order them soon.

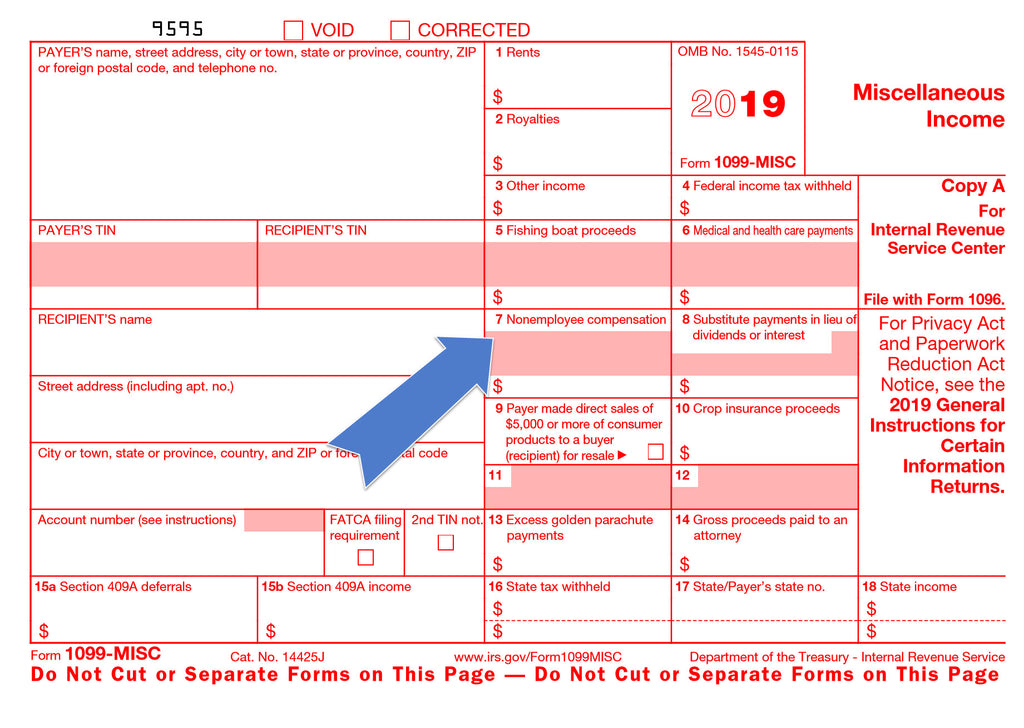

Form 1099-MISC reports to the IRS royalties, rents, and other miscellaneous income, but we are most concerned with Box 7-Nonemployee Compensation. Nonemployee compensation is the payments to workers we use throughout the year that are not on our payroll. If we paid them over $600 throughout the year, we must furnish them a Form 1099-MISC. The red Copy A must be mailed to the IRS no later than January 31 along with the Transmittal Form 1096.

You are probably thinking, “Okay, I know when they need to be filed but how do I know who gets them?”

The most difficult part of the 1099s is determining just that. Most payments to corporations and LLCs do not need to be reported on the 1099. Payments to individuals and to small businesses should be reviewed.

Keep in mind, the IRS assumes individuals working for any organization are employees unless proven otherwise. When auditing an organization, they have a list of 20 questions to determine if the worker is an independent contractor or not.

In case you are wondering why it matters, income tax and payroll taxes are withheld on employees but not independent contractors. Independent contractors have to pay the full (employee and employer) Social Security and Medicare taxes on their earnings. The IRS is concerned that businesses may classify workers as independent contractors to save on the additional employer payroll taxes.

There is some guidance on the IRS website for determining if a person can be considered an independent contractor. I’ll paraphrase it here:

What is the degree of control and independence?

1.Behavioral: Who controls or has the right to control what work is done and how it is done? If the company hires a worker for a project with a set due date and end result but doesn’t required he work on it at specific times or directs each step, the worker is considered to have the control. But if he is required to work at consistent times doing consistent things, the company or organization has the control. For example, a nursery worker in a church is considered an employee as he must work during the set church services and has a defined role. A lawn maintenance worker may be considered an independent contractor if he agrees to mow the lawn weekly, but he determines when and how it will be done.

2.Financial: Are the business aspects of the worker’s job controlled by the payer? Does the worker supply his own tools or does the company? Are his expenses reimbursed or part of the contract. Using our lawn maintenance example above, if the worker uses a lawn mower and gas supplied by the company and is reimbursed when he purchases a spare part, he may need to be considered an employee instead of an independent contractor.

3.Type of Relationship: Are there written contracts or employee type benefits? If the worker is receiving a pension plan, insurance, or vacation pay, he looks more like an employee. Additionally, if the work performed is a key aspect of the business, it is much harder to assume he is an independent contractor.

The IRS acknowledges there are no magic number of factors that makes the worker either an independent contractor or an employee.

“The keys are to look at the entire relationship, consider the degree or extent of the right to direct and control, and finally, to document each of the factors used in coming up with the determination.”

For every person you pay as an independent contractor, you must have on file Form W-9 Request for Taxpayer Identification Number and Certification. This is the form that the vendor fills out with his address and SSN or business EIN. You will use this information to complete the 1099s.

If you realize that you should have been paying the person as an employee instead of an independent contractor, you will need to revise your 941 and pay the employment taxes due (preferably before year end.) It is important to note the IRS website states, "An executive officer can be held liable for employment taxes, plus interest and penalties, if a worker is incorrectly classified as an independent contractor." So if you are unsure, play it safe by treating the person as an employee.

For more information on Independent Contractors and how to fill out the 1099, check out BANISH Your Bookkeeping Nightmares-The Go-To Guide for the Self-Employed to Save Money, Reduce Frustration, & Satisfy the IRS.

Once you have an idea of how many independent contractors you have, you can order free 1099-MISC forms from the IRS. The forms received from the IRS are the manual type with several layers. If you have more than a dozen to send, you may prefer the computer-compatible versions that you can buy from the office supply store. The additional cost will be offset by not having to manually fill in all those forms.

To get the free 1099 forms, remember:

Order immediately so they can get to you before the 1/31/19 deadline.

Order the 2018 version for this year and go ahead and, when they become available, order the 2019 version for next year, so you'll have them.

Don't forget the Transmittal-Form 1096, order two copies of each year, just in case you make a mistake.

If possible, mail them to the independent contractors as soon as possible. That way if they find any errors, you can make changes before the transmittal is submitted on January 31.

Click here to open a new window that will allow you to order them. https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns