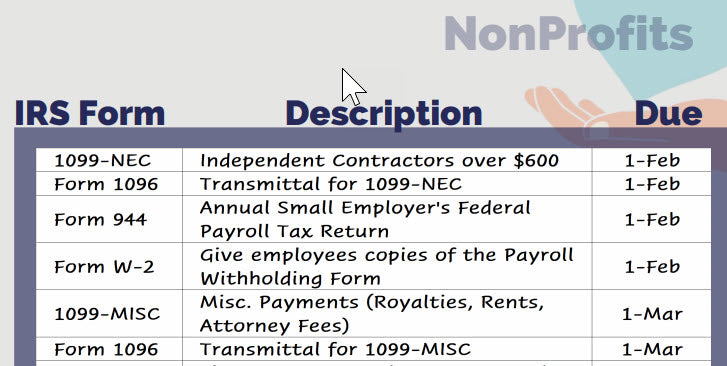

2021 IRS Deadlines for Nonprofits

No matter how small your nonprofit or church is, there are calendar year-end requirements for NPOs. Here is a list of the required filings during the first quarter of the year.

Year-End Payroll Filings

If your organization has employees, you need to issue a Form W-2 Wage and Tax Statement showing their earnings and federal and state withholding.

The first page of this form (the red copy) must be submitted with a W-3 Transmittal.

Here is a link to the IRS Form and instructions. About Form W-2, Wage and Tax Statement | Internal Revenue Service (irs.gov)

Deadline: no later than February 1, 2021 to employees and the government.

Employees should also be asked to review their Form W-4 Employees Withholding Certificate before the end of the month. This form determines the amount of federal taxes withheld for each pay period. 2021 Form W-4 (irs.gov)

Recommended Deadline: no later than February 1, 2021.

If you have annual employment tax liabilities of $1000 or less, you may be able to file Form 944 Employer's Annual Federal Tax Return instead of the quarterly 941s.

Here is a link to the IRS instructions. About Form 944, Employer's Annual Federal Tax Return | Internal Revenue Service (irs.gov)

Deadline: no later than February 1, 2021.

Independent Contractors

If the organization has paid any individuals more than $600 for services for the year, the new Form 1099-NEC Nonemployee Compensation must be completed and sent to them. For more details on this new form, see New IRS Rules for 1099 Independent Contractors (accountantbesideyou.com).

Deadline: no later than February 1, 2021.

The 1099-NECs are transmitted to the government using Form 1096 Annual Summary and Transmittal of US Information Returns.

Here is a link to the IRS instructions. About Form 1096, Annual Summary and Transmittal of US Information Returns | Internal Revenue Service (irs.gov)

Deadline: no later than February 1, 2021.

Other Miscellaneous Payments

Form 1099-MISC Miscellaneous Information is used to report royalties over $10 and payments made to individuals of at least $600 for

- Rents

- Prizes and awards.

- Other income payments.

- Payments to an attorney.

A copy is sent to the individual and COPY A is submitted to the IRS using Form 1096 Annual Summary and Transmittal of US Information Returns.

Here is a link to the IRS instructions. About Form 1099-MISC, Miscellaneous Income | Internal Revenue Service (irs.gov)

Deadline: no later than February 1, 2021, for both the 1099-MISC to the payees and the 1099s with 1096 transmittal to the IRS.

State and Local Filings for Nonprofits

You will need to check with your state’s Department of Revenue and Secretary of State websites. For your convenience, I have the links to each state on this page State Links Directory – The Accountant Beside You.

Free 2021 Filing Dates Calendar for Nonprofits

For a PDF version to print out or save, click here. You will be taken to a page to sign up for my newsletter and then given the option for a Nonprofit deadlines calendar or one that also includes personal and small business deadlines.

If you don't want to be on my mailing list, simply unsubscribe after you download the calendar.

Please share this post with anyone who may find it helpful.

Author: Lisa London, CPA, is known as The Accountant Beside You with her books being used worldwide.

ISNI 0000 0004 5059 7909