“Financial accountability is critical for your organization’s success! Make it simpler with Using QuickBooks Online for Small Nonprofits by Lisa London.”

-Jane L McIntyre Retired Executive Director, United Way Central Carolinas

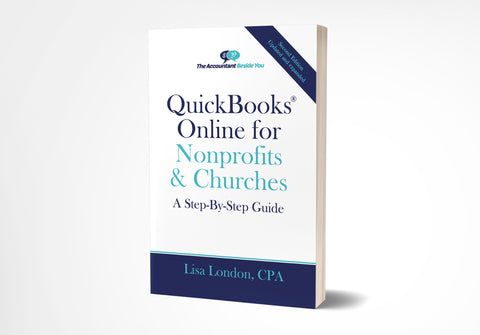

The only QuickBooks Online tutorial written specifically for nonprofit organizations.

The Accountant Beside You, CPA Lisa London, explains how to set up a nonprofit organization in the online QuickBooks® program (QBO®). In a reader-friendly and engaging style, aided by hundreds of screenshots, she explains how to enhance QBO for your organization's needs.

Topics include:

-

Sample Chart of Accounts for churches, associations, civic groups, scout troops, private schools, and other small nonprofits,

- Procedures to guard against theft and errors,

- Converting a desktop QuickBooks organization into QBO,

- Tracking donor gifts and grants,

-

Receiving money, paying bills, and tracking credit card charges,

-

Budgets and management reports, plus

- Month-end and year-end procedures and so much more.

For assistance with your organization’s accounting needs, join over 10,000 readers of The Accountant Beside You series.

Lisa London, CPA, is the author of four books in The Accountant Beside You series, including the top-selling QuickBooks® for Churches & Other Religious Organizations. She has decades of experience working with businesses as well as churches and other nonprofits.

Shipping costs are a flat rate of $4.95 for media mail or $8.95 for 2-3 day USPS Priority Mail, no matter how many books you purchase. E-Books have no shipping costs and are available for immediate download.

ISNI 0000 0004 5059 7909 Lisa London, Author