QuickTips RSS

Do I Need to File a Form 990EZ? When Do I File a 990 N or 990 EZ?

The IRS form 990 is ordinarily due by the 15th day of the 5th month after the end of the charity’s tax year. But 2020 has been anything but ordinary.

Organizations with calendar year-ends who need to file a Form 990, 990EZ, 990N, or 990T, the deadline was moved from May 15th to July 15th. It was nice to have a breather, but July 15th is going to be here before we know what hits us.

What are Unrelated Business Income Taxes (UBIT)?

You have applied for your 501(c)3 status, so you should be exempt from taxes, right? Not necessarily!

When you applied for your exemption, you told the IRS what charitable or educational purpose your organization had. The IRS then granted you tax relief for activities related to that mission.

They did not, however, give you tax relief for income not substantially related to your designated purpose.

IRS Changes for Nonprofits and Employers

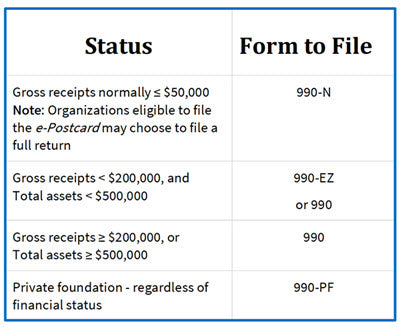

Since the Tax Cuts and Jobs Act (TCJA) in late 2017 and the Taxpayer First Act of July 2019, there are significant changes in tax regulations. The IRS issued and revised several regulations that affect nonprofits and religious organizations specifically. Here are a few you need to be aware of: Tax-Exempt Organizations must file Form 990 electronically for tax years beginning after July 1, 2019. If your tax year ends on or before June 30, 2020, you can still file via paper this year. Form 990-EZ short-form filers (revenues less than $200,000 and assets less than $500,000) have an additional...

What’s New in QuickBooks 2020 for Nonprofits?

Links to Year-End Help Blog Posts

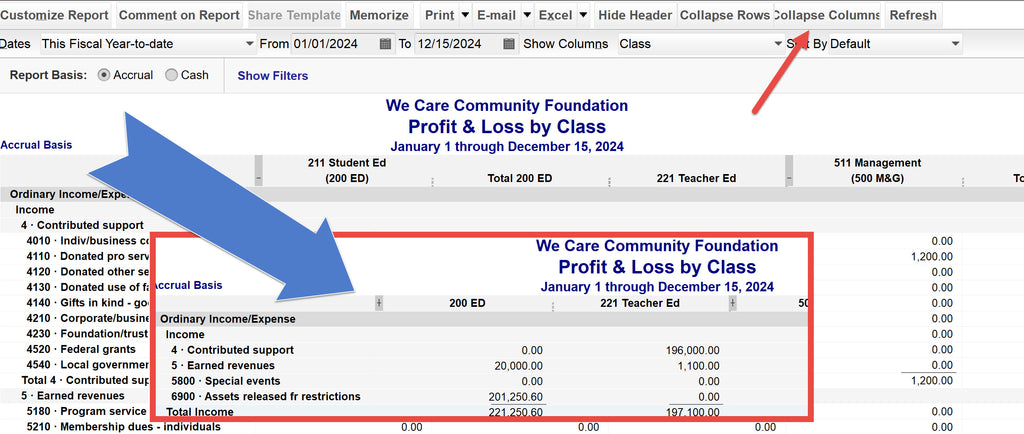

If your organization has a December 31st year end, January is a very busy time.

Besides the 1099s to independent contractors and the W-2s to employees, you also need to clean up all your accounts so your records will be correct. In this post, I’m going to link you to older blog posts to help.