QuickTips RSS

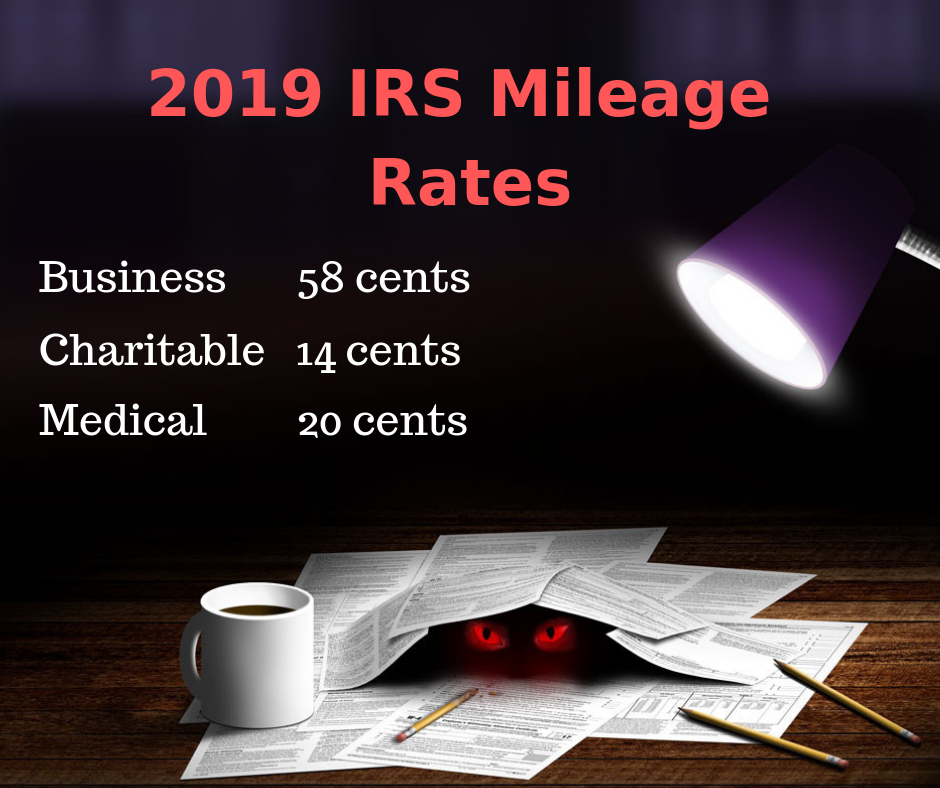

2019 Mileage Rates for Business and Nonprofit Work

Who Are Independent Contractors and How Can I Get 1099s for Free?

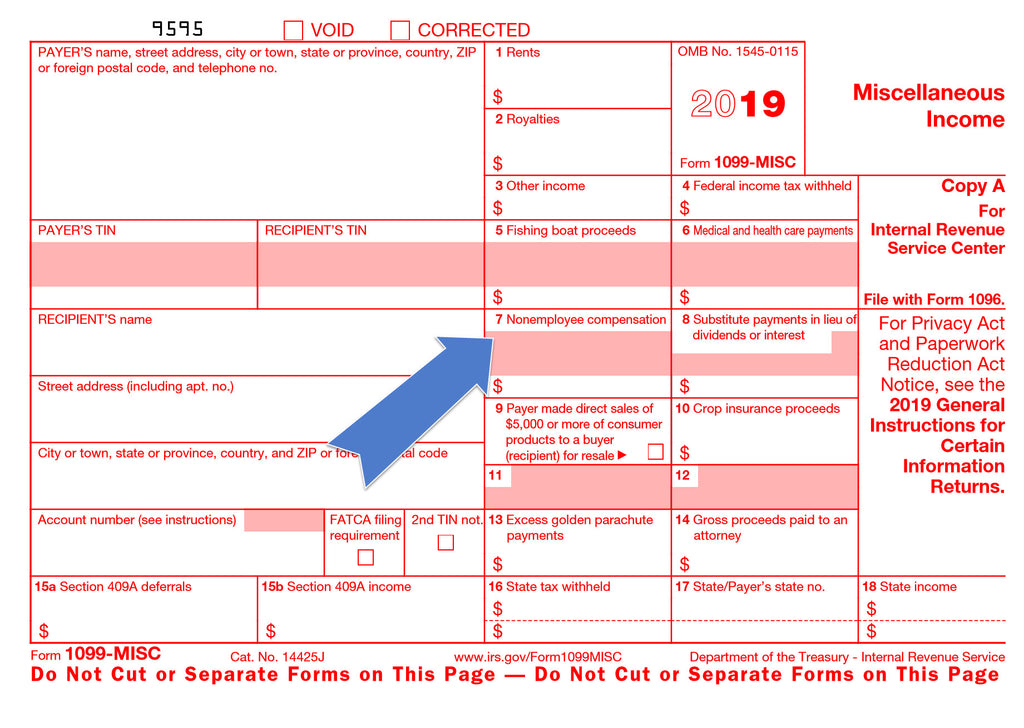

I hate to disrupt your activities during this ridiculously busy time of the year, but if you would like to receive FREE IRS Form 1099-MISC, you will need to order them soon. Form 1099-MISC reports to the IRS royalties, rents, and other miscellaneous income, but we are most concerned with Box 7-Nonemployee Compensation. Nonemployee compensation is the payments to workers we use throughout the year that are not on our payroll. If we paid them over $600 throughout the year, we must furnish them a Form 1099-MISC. The red Copy A must be mailed to the IRS no later than...

Recording Stock and Endowment/Memorial Donations With Unrealized Gains and Losses

What's New in QuickBooks 2019

This summer I had the opportunity to be a beta tester for the new 2019 QuickBooks desktop version. As I worked through the system, I was especially interested in those options that would be most useful for small nonprofits and churches.

Here is a summary of some of the new features:

Credit Cards-The Good, The Bad, and The Ugly

(This is a transcript from my Facebook Live video on March 21.) Today we are going to talk about credit cards. How they are used and misused. Tips and tricks and the need to reconcile your credit card accounts for both business and personal use. We can all agree they are convenient. You don’t have to worry about getting to the bank for cash, if you lose your wallet, you can call to have it canceled and there is a legal limit to the loss if you report in within the contractual time, and you might get cash back or...