QuickTips RSS

Recording Prepaid Pledges in QuickBooks Desktop

Are you wondering how to record the prepaid pledges donors are sending in because of the new tax reform? In this video, I'll take you through the steps to set up a prepaid pledges account that will allow the donation to reflect on the Donor Acknowledgement letter. (Please NOTE: This is designed for management reporting purposes only; specifically religious organizations who do not need to file a tax return or a 990.) Quick Summary: Set up a new account in the Chart of Accounts called "Prepaid Pledges/Unearned Donations". It must be a Current Liability. Set up a new Item as...

Prepaid Pledges in QuickBooks Online

The changes in the new tax law have driven many donors to prepay their 2018 pledges. This short video explains how to handle them in QuickBooks Online. (Please NOTE: This is designed for management reporting purposes only; specifically religious organizations who do not need to file a tax return or a 990.) Quick Summary: Set up a new account in the Chart of Accounts called "Prepaid Pledges/Unearned Donations". It must be a Current Liability. Set up a new Product/Service as a Service called "Prepaid Pledges" and tie to the Prepaid Pledges/Unearned Donations account. Record the prepaid donation as a Sales...

MileIQ App is offering The Accountant Beside You readers a 20% Discount

In Banish Your Bookkeeping Nightmares-The Go-To Guide for the Self Employed to Save Money, Reduce Frustration, and Satisfy the IRS, I explain the need for the self-employed to track their vehicle mileage in order to take advantage of the tax deduction for business travel (53.3 cents per mile in 2017). If you aren't self-employed, but drive for your volunteer work, you can also take a deduction for the miles (14 cents per mile in 2017). To track your mileage, you have to keep a travel log in your car and write down the miles as you go, or you can download an...

More Money is Stolen from Churches Annually Than is Spent on Missionary Work

CPA Lisa London explains three ways nonprofits can reduce their risk for money thefts by volunteers and employees Raleigh, N.C.: According to the Association of Certified Fraud Examiners, nonprofits lose an average of 5-7 percent of their revenues each year to fraud and theft. Brotherhood Mutual, an insurance company specializing in serving religious institutions, says that over $39 billion was stolen from churches in 2014, surpassing the $35 billion churches spent on missionary work in the same period. Certified public accountant Lisa London, author of the globally recognized guide Using QuickBooks Online for Small Nonprofits and Churches, says the thieves...

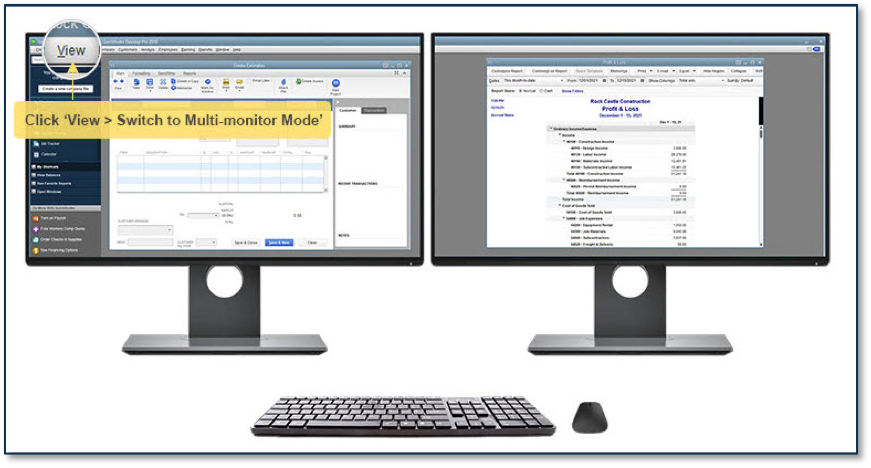

QuickBooks Desktop 2018-Changes for Nonprofits & Churches

Intuit has recently announced the latest improvements in their QuickBooks Desktop version. Though they have made some improvements I really like, none of them are so crucial that your small nonprofit or church needs to upgrade if you purchased in the last three years. Unless, the new features will help your specific workflow and save you time. My favorite of the improvements is the Multi-Monitor Support! Between my writing, accounting, email, and social media time wasting, I love to work between two (okay, actually three monitors). And trust me, if you spend a lot of time at your computer and can afford...