QuickTips RSS

What's New in QuickBooks 2016-Is it Worth Upgrading?

It is October and that means QuickBooks Desktop has a new release. If you are a nonprofit or church currently running 2014 or 2015, there is no significant reason to upgrade. They have improved some reporting and printing features, but most of the rest of the improvements are more useful to businesses.Here’s a quick summary of the substantial changes. Bill Tracker gives you a quick glance of the bills due and the ability to sort how you see them. Bills can be paid or copied from this screen. E-Invoicing has been improved. This is a fee-based service that allows you...

Endowment and Memorial Investment Accounts

Between classes and accounts, assets and equity, it can get very confusing trying to figure out how track all the related pieces of an endowment or memorial account. Let’s separate the pieces to see how to record these in QuickBooks. In this example, a generous donor has donated $10,000 of stock to seed an endowment fund. If you are going to keep this money in a separate bank account from your other investments, you will record the initial receipt as follows: Account ...

The Case for Sending Donor Statements Quarterly

Communicating with donors is a great way to keep your organization alive in their minds. Many donors only hear from the nonprofits they support twice a year-once when they ask for money and again when they receive their annual donor statement. Quarterly donor statements are a good way to thank your supporters, to let them know what good works are being done with their money, and can be a check against fraud. Additionally, if your supporters pledge or tithe, it is a pleasant way to show them how much is still due. Let's take each point individually. The donor statement...

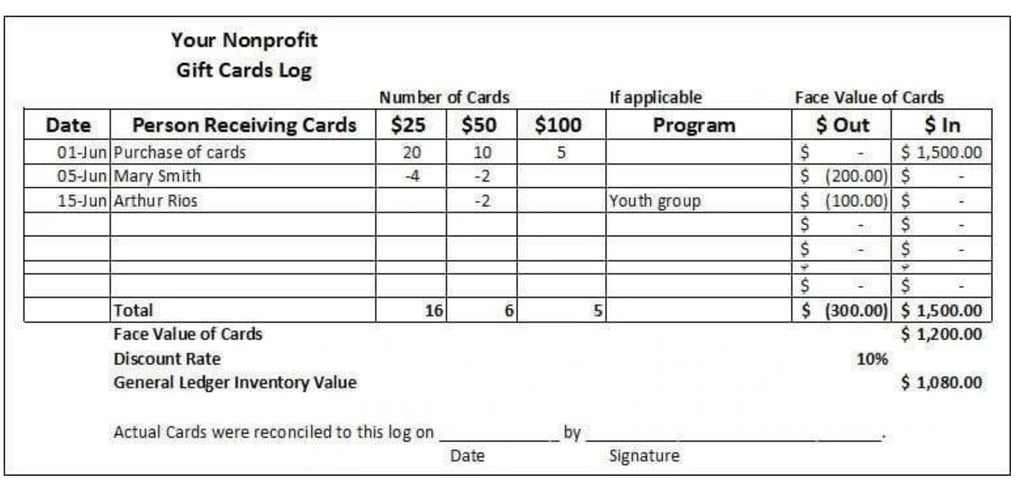

Accounting for Gift Card Fundraisers

Should My Nonprofit or Church Upgrade to QuickBooks 2015?

If your nonprofit or religious organization has been using the QuickBooks accounting system for several years, you may be wondering if it is time to look at their newer versions. Each year, Intuit (the maker of Quickbooks) offers a new version with some changes. Some years these changes are significant; other years, they are more cosmetic. The 2015 version includes a number of improvements for the outside accountant, but not so many for the end user. If you are currently using QuickBooks 2013 or 2014, I'd wait to upgrade after we see what will be introduced this fall for the...